General liability insurance is a must-have for every general contractor. It safeguards against financial losses from third-party claims of injury or property damage, which are common risks in construction. This guide explains what every general contractor needs to know about liability insurance, including essential coverage details, who needs it, and how to choose the right policy.

Key Takeaways

- General liability insurance is essential for contractors, protecting against third-party claims linked to bodily injuries and property damages, and providing financial security.

- Additional insurance policies, such as workers’ compensation and commercial auto insurance, are often necessary to cover specific risks that general liability insurance does not address.

- Choosing the right insurance provider involves evaluating coverage needs, comparing different providers, and thoroughly reading policy details to ensure adequate protection.

Understanding General Liability Insurance

General liability insurance protects contractors from third-party claims, offering financial relief from inherent construction risks. This coverage is vital as it defends against claims related to bodily injuries and property damages caused by their work. Comprehensive contractor general liability insurance safeguards your business, reputation, and financial stability by transferring financial risks to the insurance provider.

General liability insurance coverage acts as a safety net for unforeseen circumstances. It aids contractors in legal cases by covering lawsuits and settlements if they are found at fault. Without this coverage, contractors might face personal responsibility for legal judgments, leading to substantial financial losses. This insurance covers legal costs, medical expenses, and settlements from accidents causing injury or property damage, preventing significant financial exposure.

General liability insurance is essential for every contractor in the general contracting business. It protects against immediate financial damages and ensures long-term business sustainability. With a robust general liability insurance policy in place, contractors can focus on building and managing projects without constant worry about potential liability risks. Additionally, having general contractor insurance can further enhance their protection.

Who Needs General Liability Insurance?

In construction, general liability insurance is often a requirement. General contractors managing large projects and subcontractors focusing on specific tasks typically need this insurance. Developers overseeing multiple projects are also advised to carry general liability insurance to mitigate various risks, including general contractor insurance requirements.

Trade contractors, such as electricians and plumbers, should secure general liability insurance to protect against potential liabilities. Independent contractors in high-risk environments like plumbing and electrical installations also need this insurance for personal and property safety.

Liability insurance is often necessary for securing projects, demonstrating the contractor’s financial responsibility and compliance with industry standards. Project owners frequently require proof of insurance requirements and liability insurance coverage before awarding contracts, ensuring that general contractors and the project owner are protected against potential lawsuits.

Key Coverages in General Liability Insurance

General liability insurance includes various coverages designed to protect contractors from specific risks. It covers liabilities encountered on the job, including property damage and bodily injury claims. Completed operations insurance covers liability for work after project completion, while contractual liability coverage ensures agreed-upon liabilities under a contract are covered. Products and completed operations coverage protects against claims related to injuries or damage post-construction due to faulty workmanship or defective materials.

The typical cap for general liability coverage per occurrence is $1 million, underscoring the significant financial protection it offers. Medical payment coverage in liability insurance covers minor medical expenses for injured individuals on the job site, regardless of legal liability.

These coverages form a robust safety net, ensuring contractors can operate confidently, knowing they are protected against various potential liabilities.

Bodily Injury Coverage

Bodily injury coverage in general liability insurance protects against claims from third-party injuries on job sites. This includes payment for medical expenses and legal fees, ensuring contractors are not financially overwhelmed by such incidents.

Covering these costs helps contractors maintain their financial health and focus on their ongoing operations.

Property Damage Coverage

Property damage coverage within general liability insurance covers repairs or replacements of a client’s property damaged during construction work. It also pays legal fees if a contractor is sued for property damage. For instance, if a retaining wall is knocked over while excavating, this construction insurance property insurance coverage would address the costs for repairs or replacements.

This protection ensures contractors can manage unexpected incidents without significant financial strain.

Personal and Advertising Injury

Personal and advertising injury coverage protects against claims of non-physical harm, such as libel and false advertising. This coverage defends contractors against such claims, ensuring their reputation and financial stability are protected.

Securing this coverage is crucial for comprehensive risk management in the construction industry.

Additional Necessary Insurance Policies

While general liability insurance covers many risks, contractors often need additional policies to address specific risks. Pollution liability insurance covers claims related to pollution incidents, while errors and omissions insurance protects against professional mistakes. Directors & Officers Insurance ensures compliance and protects against legal issues, and umbrella insurance raises liability coverage limits beyond standard policies.

Specialized insurance programs, like wrap-ups and Owner Controlled Insurance Programs (OCIPs), are often necessary for large contractors. Medium-sized contractors should consider additional coverages such as employment practices, cyber, pollution, and professional liability insurance.

Hired and non-owned insurance is advisable for auto liability related to vehicles contractors do not own. Layering professional liability and business liability insurance helps address contract disputes more effectively. Adding additional insured endorsements to policies limits liability exposure for general contractors.

Workers’ Compensation Insurance

Workers’ compensation insurance covers medical expenses and lost wages for employees injured on the job site, including income replacement. Contractors must maintain a policy that reflects their payroll and associated job risks to ensure compliance with state laws.

Implementing a formal safety program and maintaining lower injury rates can qualify contractors for cheaper workers’ compensation premiums. A strong workers’ compensation policy protects contractors from the financial burdens of employee injuries and ensures their business operates effectively.

Commercial Auto Insurance

Commercial auto insurance is necessary for contractors using vehicles for business purposes, covering accidents involving company vehicles and providing automobile liability protection. A commercial auto policy should ensure that liability coverage is set at $1 million or higher per accident to adequately protect against potential lawsuits.

This insurance covers various types of vehicles, including trucks, vans, and cars used to transport supplies or passengers.

Professional Liability Insurance (Errors & Omissions)

Professional liability insurance, or Errors and Omissions Insurance, covers acts of errors and omissions from provided services. It protects against financial catastrophe from unforeseen oversights, providing security for contractors and client confidence. Coverage limits typically range from $1 million to $5 million per claim.

This insurance defends against lawsuits for design flaws or workmanship defects, which can arise from various mistakes.

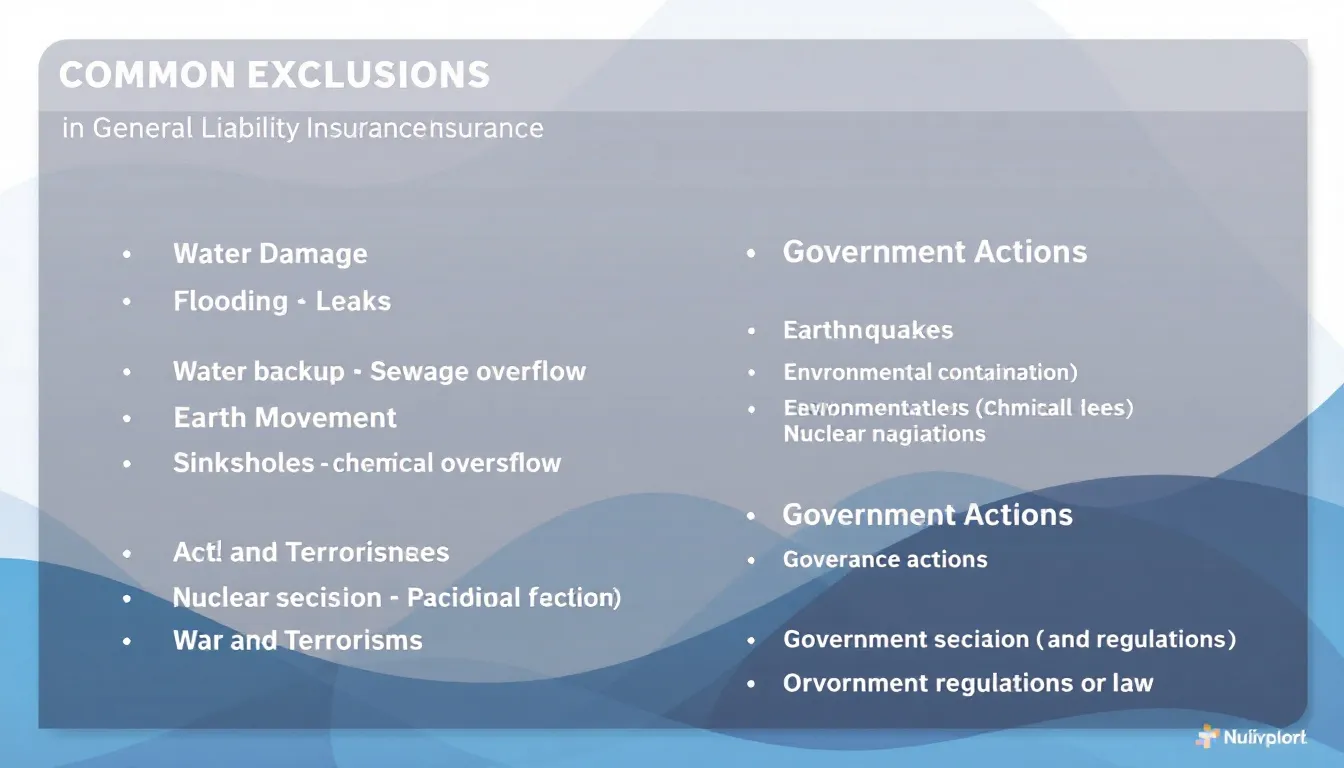

Common Exclusions in General Liability Insurance

Understanding policy exclusions is crucial, as general liability insurance does not cover intentional damage or contractual liabilities. Typically, it excludes claims arising from intentional acts committed by the insured.

Additionally, pollution liability insurance covers costs of clean-up, liability claims, and legal defense resulting from environmental incidents, which are otherwise excluded from general liability policies. Overlooking these exclusions can lead to significant financial implications, including legal costs and fines due to insufficient coverage.

Employee Injuries

General liability insurance does not cover employee injuries; these are managed through workers’ compensation insurance. Employee injuries on construction sites require specific insurance provisions to cover medical costs and lost wages, ensuring compliance with legal requirements.

Understanding the distinction between general liability insurance and workers’ compensation insurance is crucial for ensuring proper coverage for employee injuries.

Intentional Acts

Intentional acts of harm or damage are not covered under general liability insurance policies. Policies exclude coverage for actions taken with intent to cause harm or damage. Understanding these exclusions helps contractors assess their risk and ensure compliance.

Pollution

Standard general liability insurance typically offers minimal coverage for pollution-related claims, particularly regarding cleanup or remediation costs. Pollution exclusions often apply broadly, regardless of how pollutants are released, whether sudden or gradual.

Claims for environmental cleanup costs are generally not covered under standard commercial general liability policies. Contractors involved in environmental operations typically do not receive coverage for pollution claims under their general liability insurance.

The definition of ‘pollutant’ in these policies is broad, potentially including many substances not typically regarded as pollutants.

Factors Affecting Insurance Costs

The cost of general liability insurance varies widely based on several factors. Insurance companies evaluate contractors to assess risks and determine rates, with high-risk industries like construction facing higher premiums. The classification code used for workers’ compensation impacts premiums based on the nature of work performed.

Contractors should discuss the specifics of their trades and average payroll. They also need to consider project sizes when seeking tailored insurance protection. Specific risks, project size, equipment value, and the number of employees should be evaluated to determine insurance needs.

Liability limits, endorsements, and voluntary E&O coverage can significantly influence insurance costs for contractors.

Risk Exposure

High-risk industries like the construction business and construction companies face higher premiums for insurance. Contractors should assess the risks associated with their work activities to manage subcontractor liability exposure. Insurance companies view uninsured subcontractors as high risks due to the lack of control over their business operations. A construction company must be diligent in managing these risks.

Contractors should consider additional coverage beyond basic insurance if their work is deemed more dangerous.

Business Location

The location of a business property significantly impacts its insurance premiums. Urban locations often lead to higher insurance costs due to increased risk exposure and greater liability. Areas prone to natural disasters, like floods or earthquakes, may also drive up premiums, reflecting the higher risk.

Understanding how these location factors affect insurance costs is crucial for contractors to budget appropriately for coverage.

Claims History

Insurance premiums are likely to be higher for contractors with a history of frequent claims and accidents. A clean claims history can lower premiums.

Maintaining a good claims history is essential for managing insurance costs effectively.

Choosing the Right Insurance Provider

Selecting the right insurance provider is a critical step in securing your business’s future. Developing a clear strategy before seeking insurance quotes helps contractors assess agents effectively and avoid conflicts. Contractors should approach reputable insurance companies and agents to ensure their insurance needs are up-to-date. Regularly reviewing policy coverage ensures that your insurance plans meet the ever-evolving needs of your business. Specialty insurance agents, with their extensive experience, can improve the chances of finding the best deals.

To prevent conflicts when working with multiple agents, ensure they provide unique quotes and avoid duplicating the same insurance company. Insurance agents assess pricing and coverage limits during policy renewal, which is vital to understanding options. By putting your best foot forward during the insurance evaluation process, you can develop long-term partnerships and secure better deals.

Evaluate Coverage Needs

Contractors should factor in the specific risks associated with their trade when determining necessary contractor liability insurance coverage for their contracting business, including builder’s risk insurance and proper insurance. Consulting with their insurance agent can provide contractors with tailored advice for their insurance needs.

Effective risk management strategies can potentially lower risk insurance premiums, making it crucial for contractors to evaluate and address their coverage needs comprehensively.

Compare Providers

Comparing different insurance companies is crucial for finding the right coverage for your needs and ensuring that you’re getting the best rates. When evaluating coverage options, consider your specific risks and the types of coverage offered by most insurance companies to ensure adequate protection. Factors such as risk exposure, business location, and claims history can significantly affect insurance costs, making it essential to understand how these aspects influence premiums.

Thoroughly reading policy details is important to understand coverage specifics, exclusions, and any conditions that may apply.

Read Policy Details

Reading the details of the insurance policy is crucial to avoid losing the gig due to missed details. When you review policy documents, pay attention to coverage levels and exclusions. Also, consider the deductibles and limits. General contractors must carefully check for any clauses that could restrict coverage based on project specifics.

For clarifying information about liability insurance policy coverage, consult an insurance agent or legal adviser.

How to File a Claim

Filing a claim typically involves contacting your insurer right after an incident occurs. Organized records expedite claims processes and prove involvement in incidents. Following a defined procedure is crucial for successfully filing a claim under general liability insurance. This ensures that your claim is processed efficiently and that you receive the necessary coverage to address any damages or injuries.

Immediate Reporting

Contacting your insurer immediately after an incident is crucial to initiate the claims process effectively. You should notify your agent or insurer right away to ensure that your claim can be handled promptly. Immediate reporting helps in documenting the incident accurately, which is essential for a smooth claims process.

Documentation

Providing detailed documentation to support the claim is essential. Proper documentation serves as proof to validate the claims being made. If there are injuries from an incident, seek medical care promptly to ensure that medical expenses can be covered and to help cover medical bills.

Comprehensive documentation helps in establishing the legitimacy of the claim and facilitates a quicker resolution.

Claim Processing

After you provide the necessary information for a claim, the insurer registers the claim and assigns a unique registration number. The claims process involves an assessment to determine the legitimacy of the claim before moving towards settlement.

Once the insurer reviews the surveyor’s assessment, they confirm liabilities and proceed with settlement. Maintaining orderly claim records can establish credibility as a low-risk client and may improve claim approval rates.

Summary

In the ever-evolving field of general contracting, understanding and securing the right insurance coverage is paramount. General liability insurance forms the bedrock of this protection, shielding contractors from financial turmoil due to third-party claims. By comprehensively covering bodily injury, property damage, and personal and advertising injury, this insurance ensures that contractors can focus on their projects without the constant worry of potential liabilities. Moreover, additional necessary policies like workers’ compensation, commercial auto insurance, and professional liability insurance further bolster this protection. Being aware of common exclusions, understanding factors affecting insurance costs, and choosing the right provider are crucial steps in this journey. By following the outlined steps for filing a claim, contractors can ensure that they are well-prepared to handle any incidents that arise. In essence, securing robust liability insurance is not just about compliance – it’s about safeguarding the future of your business.

Frequently Asked Questions

Who needs general liability insurance?

General liability insurance is essential for general contractors, subcontractors, and trade contractors such as electricians and plumbers to safeguard against potential liabilities and meet contractual obligations. It is a crucial aspect of their risk management strategy.

What does bodily injury coverage include?

Bodily injury coverage includes protection against claims from third-party injuries, covering medical expenses and legal fees that arise from incidents occurring on job sites. This ensures that you are financially safeguarded from potential liabilities.

Why is workers’ compensation insurance important for contractors?

Workers’ compensation insurance is crucial for contractors as it safeguards against hefty financial losses by covering medical expenses and lost wages for injured employees, while also ensuring compliance with legal obligations.

What are common exclusions in general liability insurance?

Common exclusions in general liability insurance include employee injuries, intentional acts, and pollution-related claims, necessitating additional policies for complete coverage. It’s crucial to review your insurance needs to fill these gaps effectively.

How can contractors reduce their insurance premiums?

To effectively reduce insurance premiums, contractors should implement thorough risk management strategies, maintain a clean claims history, and frequently review their coverage with an insurance agent to avoid over-insurance while ensuring adequate protection.