Looking to learn how to save on classic car insurance without sacrificing coverage? This article reveals practical strategies to help you lower premiums while keeping your prized possession well protected. From understanding agreed value coverage to utilizing mileage restrictions and opting for secure storage, we’ll cover effective methods to ensure you benefit from comprehensive coverage at a more affordable cost.

Key Takeaways

- Agreed value coverage is vital for classic car insurance, ensuring compensation reflects the vehicle’s true value at the time of a total loss.

- Utilizing mileage restrictions and secure storage solutions can significantly reduce insurance premiums, enhancing both safety and financial savings.

- Regular maintenance, accurate documentation, and participation in classic car clubs can lead to favorable insurance terms and additional discounts.

Understand Agreed Value Coverage

Agreed value coverage serves as the cornerstone of classic car insurance. It is crucial for safeguarding the value of these vehicles. This type of coverage protects your investment from depreciation and market fluctuations. Unlike standard policies that consider the actual cash value, agreed value coverage ensures that you’re compensated based on a pre-determined value for your vehicle.

This means that in the unfortunate event of a total loss, you receive a payout that truly reflects the car’s worth at the time the policy was agreed upon.

Importance of Agreed Value

Agreed value coverage offers classic car owners peace of mind by guaranteeing a pre-determined payout in the event of a total loss. This coverage means you won’t have to worry about depreciation diminishing the value of your payout. Instead, you will receive the full amount agreed upon at the inception of the policy, providing a financial safety net for your prized possession.

The agreed value is typically evaluated annually, considering the car’s condition, mileage, and historical significance. Using detailed appraisals and market data, insurers can set an upfront payout amount that accurately reflects your car’s worth. This method stands in stark contrast to actual cash value coverage, where depreciation negatively impacts the payout amount.

Negotiating Agreed Value

Negotiating the agreed value of your classic car is a critical step in ensuring you receive full compensation reflecting its worth. To achieve the best possible agreed value, engage your insurance provider with comprehensive documentation about the car’s condition, market value, and any enhancements or restorations. Highlighting your car’s unique features and historical significance can also strengthen your case.

Effective negotiation not only protects your investment but also ensures peace of mind, knowing you are adequately insured. Remember, the goal is to have the insurer agree to a value that truly mirrors your car’s worth, ensuring you’re not left short-changed in the event of a claim.

Utilize Mileage Restrictions

Mileage restrictions can be a powerful tool for reducing your classic car insurance premiums. Insurance companies frequently offer reduced rates for classic cars. This is typically applicable to vehicles that are driven infrequently. This is because driving less decreases the risk of accidents, which in turn lowers the insurance costs.

However, it’s important to balance these restrictions with how often you plan to use your vehicle, as a policy with a mileage limitation might not be suitable for frequent drivers.

Limited Usage Discounts

Classic car insurers often enforce mileage caps to minimize risks and subsequently lower the insurance premiums. These restrictions typically range from 2,500 to 7,500 miles per year. Driving your classic car less can significantly reduce your insurance costs, as limited usage is perceived as less risky by insurers.

Factors influencing antique car insurance rates include the type of vehicle, storage method, and mileage. Limiting the annual mileage for classic cars can lead to substantial savings, making it an attractive option for those looking to save money on their premiums.

Honest Reporting

Accurate mileage reporting is crucial to ensure that the coverage matches the actual usage of the vehicle. Dishonest reporting can lead to discrepancies that could jeopardize your insurance claims.

Always be truthful about your driving habits to maintain appropriate coverage without sacrificing coverage.

Secure Storage Solutions

The location where you store your classic car can have a considerable effect on your insurance premiums. It’s important to choose a secure storage option. Storing your vehicle in a locked garage not only enhances its safety but can also lead to discounts on insurance premiums. Secure storage solutions mitigate risks, providing both financial security and peace of mind.

Make sure your storage meets the insurance provider’s standards to maintain coverage.

Locked Garage Benefits

Storing classic cars in a secured environment like a locked garage usually results in reduced insurance premiums. Insurance providers recognize a locked garage as a secure storage option that enhances the safety of your vehicle, leading to lower premiums and financial savings.

Adding Security Features

Enhancing the security of your classic car with alarms or surveillance cameras can significantly bolster its protection. These safety features not only offer peace of mind but also contribute to financial security through potentially lower insurance premiums.

Maintain a Clean Driving Record

A clean driving record is crucial for keeping your classic car insurance premiums low. A clean record indicates to insurers that you are a lower risk of making claims, which can result in discounts and more favorable insurance terms.

Conversely, a bad driving record can make it difficult to secure classic car insurance.

Safe Driving Habits

Classic car owners should practice safe driving habits to maintain a clean driving record. Insurance companies view a safe driving history as indicative of risky driving behavior.

Consistent maintenance records can also influence premium rates favorably by indicating a lower risk for insurers.

Impact of Violations

Traffic violations can lead to increased insurance premiums and make it challenging to secure coverage. Serious infractions may result in higher premiums or difficulty obtaining insurance, which are primary factors in determining overall risk.

Avoiding distractions, practicing defensive driving, and regularly reviewing local traffic laws can help prevent violations and enhance safety.

Join Classic Car Clubs

Joining classic car clubs can provide numerous benefits, including significant savings on insurance. These clubs often provide access to special insurance offers and discounts not available to the general public.

Additionally, these clubs offer unique networking opportunities, allowing members to connect, share knowledge, and gain insights into maintenance and insurance solutions.

Club Membership Discounts

Many insurance providers offer premium reductions specifically for members of established classic car clubs. By partnering with insurance companies, these clubs can offer their members exclusive discounts that enhance the overall value of the insurance policy.

Networking Opportunities

Classic car clubs offer unique networking opportunities for enthusiasts to connect and share knowledge, including insights gained from attending car shows. These connections promote the exchange of insights about maintenance, restoration, and insurance solutions, further enhancing the benefits of club membership.

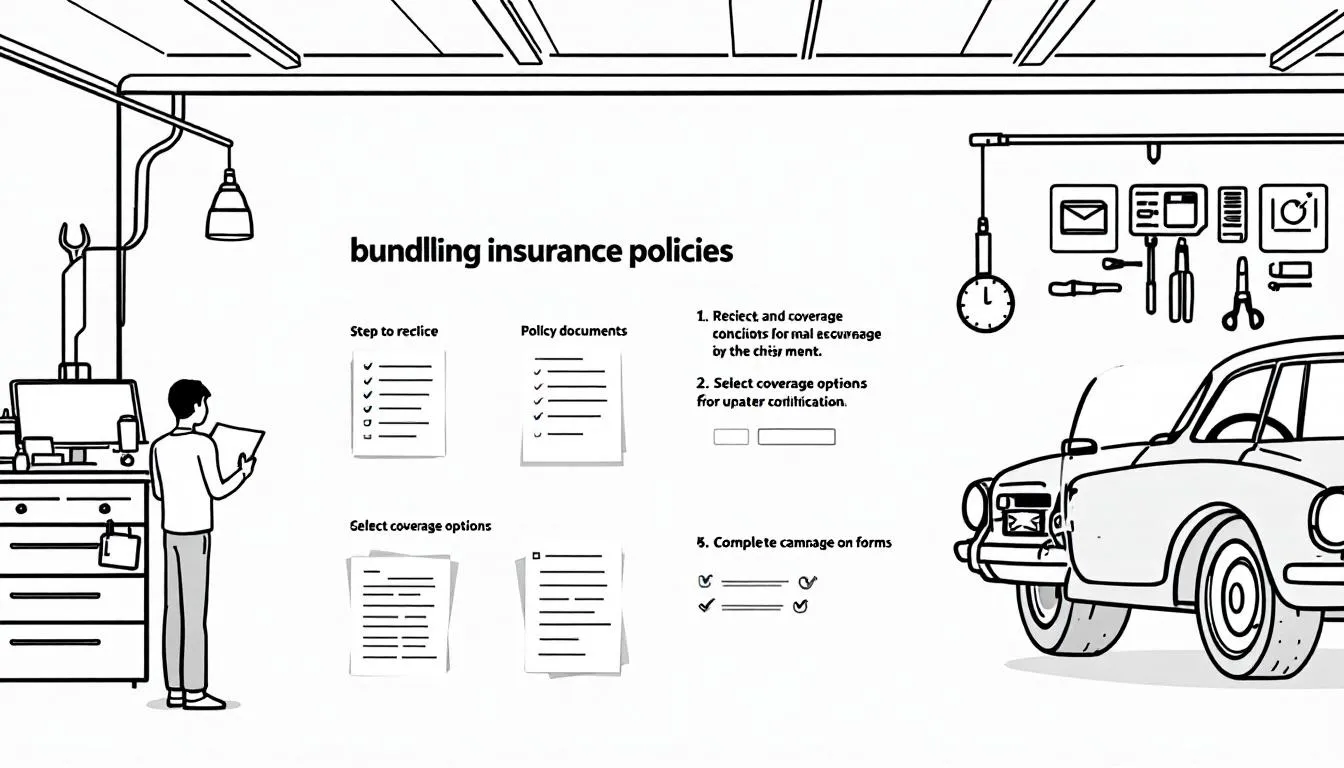

Bundle Insurance Policies

Bundling your classic car insurance policy with other policies, such as home or life liability insurance, can significantly reduce overall costs. This approach not only simplifies your auto insurance management but also helps maintain comprehensive coverage while keeping premiums low.

Many insurance companies offer discounts for multiple policies holders, and most insurers make it a strategic way to save on premiums.

Multi-Policy Discounts

Exploring various bundling options with your insurance provider can maximize savings on premiums. Bundling classic car insurance with home or life insurance often leads to substantial premium reductions, making it an attractive option for classic car owners looking to save on insurance costs.

Choosing the Right Provider

Choosing a specialized provider for classic car insurance ensures you receive tailored coverage and potentially better discounts. Evaluating customer reviews and checking the financial stability of the insurance company are essential steps in selecting the right provider.

Providers specializing in classic car insurance commonly offer better multi-policy discount opportunities, enhancing savings for owners through classic car insurance companies and classic car insurance policies.

Evaluate Deductible Options

Adjusting your deductible can significantly influence your insurance premium rates. Selecting a higher deductible can reduce your insurance premiums and help achieve lower insurance costs, making it financially beneficial for cautious drivers.

However, choosing a deductible requires careful consideration of both your financial situation and the potential out-of-pocket costs associated with claims.

Higher Deductibles for Lower Premiums

Choosing a higher deductible can lead to substantial savings on your monthly insurance costs. This approach is particularly beneficial for individuals who rarely file claims, as the reduction in premium expenses over time can be significant. Opting for a higher deductible can help allocate funds more efficiently, ensuring your classic car remains well-protected without straining your budget.

However, it’s essential to be mindful that deductibles are the amount you pay out-of-pocket before your insurance coverage kicks in. Therefore, choosing a substantially higher deductible can save you significantly on monthly premiums but requires preparation for higher out-of-pocket costs in the event of a claim.

Assessing Risk Tolerance

Understanding deductible options is crucial for managing your overall insurance costs effectively. Different deductible options can greatly influence your insurance premium costs and should be carefully assessed. By considering your financial situation and risk tolerance, you can select a deductible that balances potential savings with your ability to cover out-of-pocket expenses if needed.

Compare Quotes from Multiple Providers

Comparing quotes from different insurers is a key step in identifying the most cost-effective options available for classic car insurance. Gathering quotes from various insurance companies helps determine which provider offers the best combination of coverage and price.

This process not only helps in finding lower premiums compared but also ensures you receive quality coverage tailored to your needs.

Online Comparison Tools

Utilizing online comparison tools can significantly streamline the process of finding the most cost-effective and suitable affordable classic car insurance coverage. Various platforms allow users to easily compare quotes from multiple companies, making it simpler to identify specific discounts and evaluate the overall value of different policies.

These tools are invaluable for consumers seeking to save money while ensuring their classic cars and vintage vehicles, including classic vehicles, are adequately protected with classic car coverage in consumer affairs for every car owner. Collectible cars are also an important consideration for enthusiasts.

Evaluating Coverage Details

When comparing quotes, it’s crucial to closely evaluate the coverage details of each policy. Look beyond the premiums and consider aspects such as:

- Agreed value coverage

- Liability coverage

- Comprehensive coverage

- Collision coverage.

Additionally, check for any specific discounts or bundled options that could further reduce your insurance costs. Making sure your policy provides appropriate coverage without sacrificing quality is key to protecting your investment.

Take Advantage of Lay-Up Periods

Lay-up periods offer classic car owners the opportunity to save money by adjusting their insurance coverage during times when the car is not in use. Insurers acknowledge the reduced risk during these periods, often decreasing premiums accordingly, which aligns with usage based insurance practices.

By utilizing lay-up periods, you can significantly lower your insurance costs while ensuring your car remains protected against potential risks even when it’s off the road.

Seasonal Insurance Adjustments

Adjusting insurance coverage during off-seasons can lead to significant premium savings for classic car owners. Since classic cars are typically not exposed to risks associated with daily driving during these periods, sacrificing coverage can result in lower premiums.

This allows you to save money while saving money on your car insurance against potential damages incurred while in storage.

Informing Your Insurer

Notify your insurer in advance when you plan to place your classic car in storage to fully benefit from lay-up periods. This ensures that your coverage is adjusted, and the appropriate premiums are applied.

Regular communication with your insurer helps optimize your insurance policy to reflect the current status of your classic car, providing both protection and cost savings.

Regular Maintenance and Documentation

Consistent upkeep of your classic vehicle can positively affect your insurance terms, often leading to lower premiums. Being part of classic car communities fosters valuable connections and knowledge sharing about maintenance, restoration, and insurance, especially when you maintain your classic car regularly.

Detailed maintenance records and regular condition appraisals ensure your well maintained insurance coverage aligns with the car’s current value, protecting you from financial loss.

Maintenance Records

Keeping detailed records of all maintenance activities is crucial for supporting insurance claims on your classic car. Insurers may require the following as evidence when assessing claims:

- Photos

- Appraisals

- Proof of restoration work Immediate documentation of any incidents, including photos of visible damage, can greatly assist with the claims process and ensure you receive fair compensation.

Condition Appraisals

Periodic appraisals are essential for classic car owners to reflect the true condition and value of their vehicle in the insurance policy. Regular appraisals ensure your insurance coverage aligns with the car’s current market value, protecting you from underinsurance and ensuring adequate compensation in the event of a total loss.

Summary

Navigating the world of classic car insurance can be complex, but with the right strategies, it’s possible to secure comprehensive coverage without breaking the bank. By understanding and negotiating agreed value coverage, utilizing mileage restrictions, securing proper storage, maintaining a clean driving record, joining classic car clubs, bundling insurance policies, evaluating deductible options, comparing quotes, taking advantage of lay-up periods, and keeping meticulous maintenance records, you can effectively manage your insurance costs while safeguarding your prized possession.

In essence, protecting your classic car is about more than just finding the cheapest policy. It’s about ensuring that every aspect of your coverage is tailored to your vehicle’s unique needs. By following these tips, you not only save money but also gain peace of mind, knowing that your classic car is well-protected. So, take these insights to heart and enjoy the open road, confident in the knowledge that you’ve made wise choices for your beloved classic car.

Frequently Asked Questions

What is agreed value coverage and why is it important for classic cars?

Agreed value coverage is crucial for classic cars as it guarantees a pre-determined payout in the event of a total loss, safeguarding owners from depreciation and market fluctuations. This ensures that the value of the vehicle is accurately reflected at the time the policy is established, providing peace of mind.

How can mileage restrictions help reduce my classic car insurance premiums?

Mileage restrictions can significantly lower your classic car insurance premiums by minimizing the risk of accidents associated with less frequent driving. Policies that incorporate these limitations typically provide reduced rates due to the lowered exposure to potential claims.

Why is it beneficial to store my classic car in a locked garage?

Storing your classic car in a locked garage is beneficial as it enhances security and may lower insurance premiums. This protects your investment while offering you peace of mind.

How can joining a classic car club save me money on insurance?

Joining a classic car club can save you money on insurance by providing access to exclusive discounts and special offers that are not available to the general public. Additionally, networking opportunities within the club can help you gain valuable insights into maintenance and insurance solutions.

What are lay-up periods and how can they save me money?

Lay-up periods allow classic car owners to temporarily reduce their insurance coverage while the vehicle is not in use, leading to lower premiums and substantial cost savings. Adjusting your policy during these times can effectively minimize your expenses.